- The Ultimate Guide to Finding the Best Robot Vacuum for Dog Hair - June 2, 2024

- How to Make Your Home Smart: A Comprehensive Guide - May 28, 2024

- How to Make Your Home a Smart Home: A Comprehensive Guide - May 26, 2024

Artificial intelligence developments are moving fast in the world we live in, and banks need to integrate the latest AI applications to keep up with the competition.

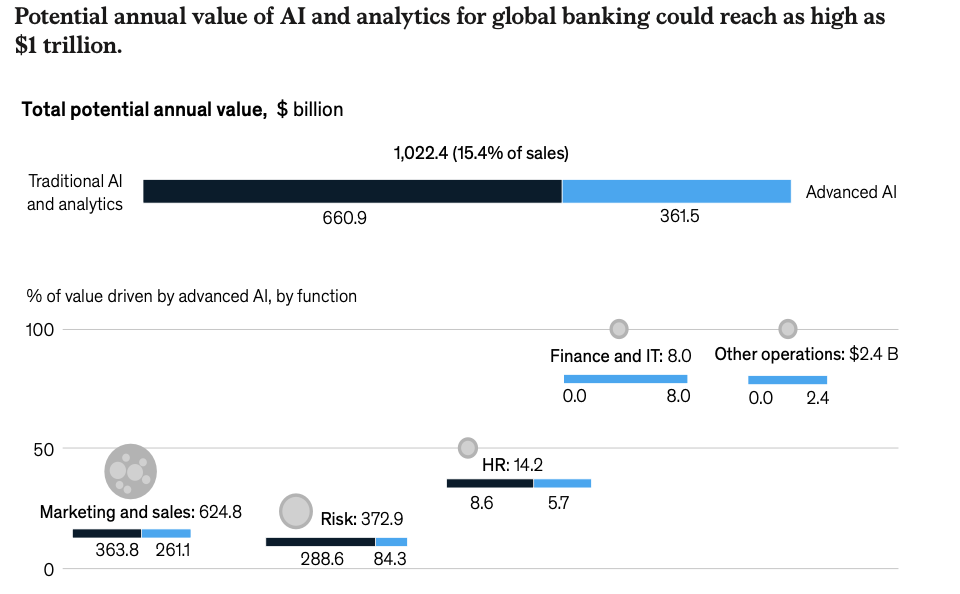

According to a report by McKinsey (2021), the AI potential for banks is one of the largest. It can potentially unlock $1 trillion of incremental value for banks.

To maximize this value potential, it’s important that banks and financial institutions apply AI applications correctly to their internal systems and processes.

We’ll discuss what the latest AI trends in banking are and how it is currently applied. The paper of Malali and Gopalakrishnan (2020) is used as the backbone of this article.

Source: McKinsey & Company: Building the AI bank of the future (2021).

What are the latest AI trends in banking?

- Prohibited transaction management

- Wealth management for the masses

- Automated customer support

- Trading and investment strategies

- Decision-making

- Virtual financial assistants

- Claims management

- Cybersecurity system

Now, let’s dive in to the most recent AI trends in banking.

1. Prohibited transaction management

With my own working experience at a bank, I have seen that AI is used for detecting prohibited transactions. Here in the Netherlands, banks are obligated by law to know their customer and detect possible fraud, anti-money laundering, or sanction-related transactions.

AI algorithms analyze large data sets to identify patterns, transaction history, anomalies, and customer behavior. In this way, prohibited transactions are triggered and analysts can then further investigate the transaction.

Banks are the financial gatekeepers in society. By detecting prohibited transactions, AI helps banks avoid image damage.

Let’s move on to the other latest AI trends in banking.

2. Wealth management for the masses

Most of the banks offer an app to their customers where they can manage all their payments. Within these apps, automated advisory services are embedded. This service is based on AI and observes the incoming cash flows and buying behavior of the customer. It recognizes patterns and when a customer spends more than what is coming into the bank account, then the app advises to trim down expenses.

This trend can give customers better insight into their spending patterns. It can lead to customers trimming down their costs and a better customer experience.

3. Automated customer support

As in many other industries, AI is used to provide customer support in the banking industry as well. AI-powered chatbots, AI-powered assistants, voice systems, and text chats are all functionalities that make automated customer support possible.

These applications make use of machine learning algorithms and natural language processing to provide answers to simple questions. Moreover, AI-powered assistants are able to assist customers with banking processes and offer personalized services.

The benefit is that AI partly takes over the work of customer service representatives. Their workload reduces and they have more time to help customers with complex questions.

4. Trading and investment strategies

Successful trading for banks depends upon the capability of forecasting the market. To predict markets, systems play a key role since they can gather large amounts of data in a short period of time. Data previously collected is used to predict future price action.

AI brings solutions for various types of traders. A trader who takes more risk could use indicators that show when to buy, sell, or hold a stock. These indicators are based on historical data and AI uses this data to forecast the market.

A recent development is trading bots being launched. These bots automate the trading process and are mostly used in the 24/7 cryptocurrency market.

By embracing the power of AI, banks and financial institutions can make data-driven decisions to improve their portfolio performance.

5. Decision-making

Banks have large amounts of structured and unstructured data sets. AI is able to help data analysts with analyzing this data.

Analyzing data sets helps data analysts identify investment opportunities and forecast the market. Data analysts report their findings to managers and they are able to make better decisions for the future.

6. Virtual financial assistants

AI-powered financial experts support customers to make effective and efficient investment decisions. The assistant is able to advise customers on what stocks to buy and sell.

The advice is based on AI that uses historical data to predict the future market. These kinds of assistants are sometimes also called ‘Robo-Advisors’.

7. Claims management

In the case of claims administration, AI-enabled technologies play a major role. Machine learning techniques especially help to bypass a number of stages in the claim settlement process.

AI-powered technologies ensure that data management is effectively processed. It is able to process a large volume of data within a short time span. This results in a shorter overall processing time which also improves customer experience.

8. Cybersecurity system

Cybercrime is a development that banks carefully have to protect against. It’s important that data breaches with sensitive customer data are prevented as much as possible.

Luckily, AI applications have been developed over the past years that strengthen cybersecurity within banks. The AI application is able to analyze threats, learn from patterns, and significantly mitigate the risk of security breaches.

These AI applications are a helpful outcome for banks to protect their customer data and internal systems.

Summary of AI trends in banking

The latest AI trends in banking show how banks currently apply the latest AI applications within their organization. If done correctly, the incremental value potential could be enormous.

Banks and financial institutions use AI applications for among others detecting prohibited transactions, managing wealth for the masses, trading and investment strategies, decision-making, and customer support.

It’s interesting to see how large banks integrate AI solutions into their settled processes. Definitely a development that we keep a close eye on.

References

Malali, A.B., & Gopalakrishnan, S. (2020). Application of Artificial Intelligence and Its Powered Technologies in the Indian Banking and Financial Industry: An Overview. Journal of Humanities And Social Sciences, 25 (4), 55-60.